Caretaker Finance Minister Shamshad Akhtar stated the obvious when she stressed that Pakistan will remain dependent on the International Monetary Fund (IMF) for some time. Still, it is better than empty promises of never going to the IMF again, though those sweet nothings are expected from those who wish to be elected rather than the caretaker setup.

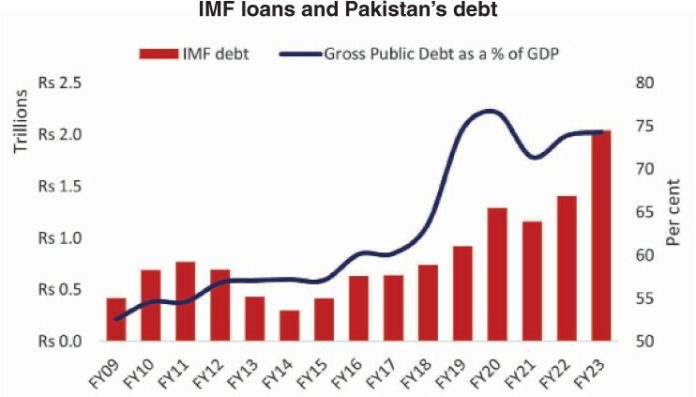

Pakistan’s debt has climbed alarmingly in the last fiscal year. While the pandemic did the country no favours, the Russia-Ukraine conflict made the already fragile global economy more precarious through energy price shocks. Domestic political instability delayed the tough decisions that could have slowed the downward slide.

To borrow to service debt and pay off loans is to paddle in a sinking boat. And Pakistan’s economy has more holes than Swiss cheese.

But Pakistan is not the only one drowning. At $235tr, total debt stood at 238pc of global GDP last year, nine percentage points higher than in 2019, according to the IMF.

Similar to Pakistan, other countries ran higher fiscal deficits to push their citizens through the hard times. The governments borrowed to spend, trying to boost growth and respond to inflation caused partly by food and energy price spikes.

While the pandemic and Russia-Ukraine conflict are the leading recent factors to cause economic turmoil internationally, global public debt has tripled since the mid-1970s to reach 92pc of GDP by the end of 2022. The governments’ habit of borrowing to spend had been accelerating long before the coronavirus infected the first person.

But Pakistan’s debt spiral is worse than those experienced by stable economies. Impoverished nations find it hard to raise enough revenue to pay off debt. Weak democracies can not impose strong decisions that break power lobbies and benefit the common man.

Given the government’s commitment to regular tariff adjustments, including gas price hikes, it would be hard for SMEs to remain in business, especially in a high-interest rate environment that discourages borrowing. Decreased economic activity and higher inflation are not conducive to higher tax revenue, ensuring that Pakistan remains caught in the debt spiral.