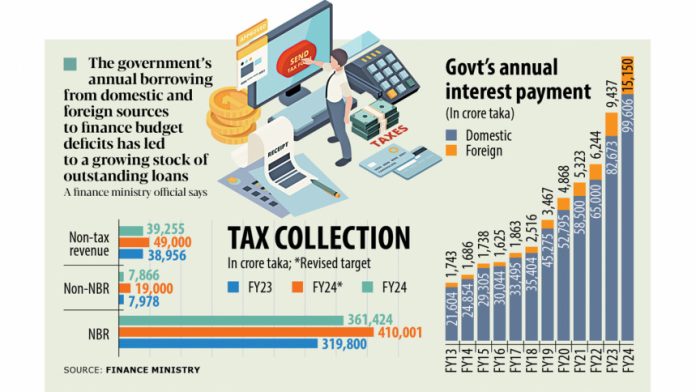

The government’s interest payments against loans surged 24.5 percent in fiscal year 2023-24, exceeding the Tk 100,000 crore mark for the first time in history, thanks to higher borrowing costs for loans from both domestic and foreign sources.

According to the finance ministry’s fiscal report released yesterday, over Tk 114,000 crore was spent on interest payments in FY24, representing more than one-sixth of the national budget.

While spending on subsidies decreased slightly, the government missed the revenue targets set by the International Monetary Fund (IMF) for its ongoing $4.7 billion loan programme.

Initially, the government allocated Tk 94,376 crore for interest payments in FY24. However, this figure rose to over Tk 105,000 crore in the revised budget.

However, the actual figure even overshot the revised mark, indicating the government’s dependence on borrowing to finance budget deficits.

Interest payments for foreign loans increased 60.53 percent to Tk 15,150 crore last year while rising 20.48 percent to Tk 99,606 crore for domestic loans.

A finance ministry official said the government’s annual borrowing to finance budget deficits had led to a growing stock of outstanding loans.

As of March 2024, the government’s total outstanding debt stood at Tk 1,697,415 crore, which is equivalent to 33.78 percent of the country’s gross domestic product (GDP).

The Finance Division’s Medium-Term Macroeconomic Policy Statement (MTMPS) said that interest payments would continue to rise gradually in the coming years.

The report mentioned that the proportion of external interest payments as a percentage of the national budget would rise to 2.6 percent in FY27 from 0.9 percent in FY22, reflecting the growing impact of external debt on the budget.

The report also said two major factors contributed to the increase in interest payments for foreign loans.

It further anticipated that reference rates in advanced economies, which serve as benchmarks for setting other interest rates, would remain elevated for some time.

Besides, Bangladesh’s graduation from least developed country status in 2026 will gradually limit access to concessional loans from external sources, increasing borrowing pressure.

“This increase is attributed to a higher proportion of borrowing through floating and semi-concessional rates, which are more sensitive to market fluctuations compared to fixed-rate financing,” said the report.

Moreover, the depreciation of the local currency taka against the US dollar has inflated the value of external debt when measured in terms of the local currency.

Regarding domestic borrowing, the banking sector has been the main source of funds. The Bangladesh Bank’s recent policy rate increases have contributed to rising interest payments on domestic loans.

SUBSIDY EXPENDITURES DECLINE SLIGHTLY

The government has also been facing a new challenge due to significantly increased subsidy expenditures in recent years.

As such, the IMF has been pushing the government to reduce these expenditures by raising power and fertiliser prices.

In FY24, the government spent less on subsidies than allocated in the revised budget. In the revised budget, the total subsidy allocation was Tk 85,906 crore, but actual spending amounted to Tk 72,497 crore.

IMF TARGET MISSED AGAIN

After the IMF approved a $4.7 billion loan programme in January last year, the government struggled to meet the targets set for revenue and foreign currency reserves. In most cases, it has failed to achieve the targets.

As a result, the government had to seek a waiver for disbursal of three tranches of the loan so far.

For the fourth tranche, the IMF has set the target for tax revenue collection at around Tk 394,000 crore by June this year.

At the end of the last fiscal year, the government’s tax revenue collection was Tk 369,000 crore, meaning it missed the target by Tk 25,240 crore.