Nathaniel Tapin says about China’s debt laden economy and struggling property developers that this has been seen before. What matters most is the confidence household borrowers have in the country to buy homes and spend versus putting more money into savings. And this confidence that that has been the strength of the economy for three decades is fading. About 12 million jobs in the internet platform economy were lost in 2020-2022. This absorbed a fourth of the Chinese graduating from colleges each year. The manufacturing sector is affected by declining demand overseas and cannot pick up for this. Much of this is a result of Xi’s government efforts to tamp down debt of housing developers, to reduce housing speculation, to limit the power of internet companies, and develop a fairer economy, and these were policy decisions not easily reversed.

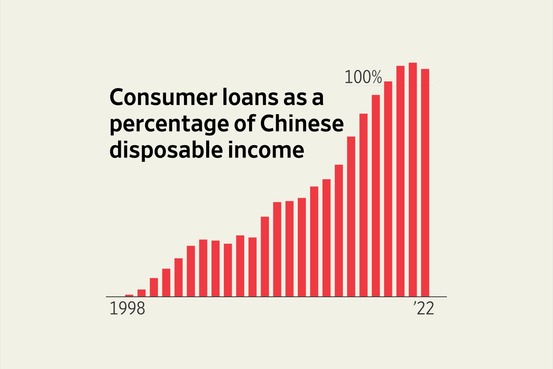

A pervasive pessimism is leading to a disinclination to spend or buy a house. Surveys of Bank of China show inclination to save increased by 15 percentage points to 58% in second quarter 2023. In the past Chinese put money in homes as a way to deposit money in a savings account, homes were sold even before they were built. This cash was passed on to property developers and in turn the local governments benefited by selling the land to property developers. After property developers could not pay interest on debt and collapsed the households decided to pay down their mortgages and $28 billion went to pay down residential mortgage debt in first 6 months of 2023.